Casey�s General Stores, Inc. (Nasdaq: CASY) today reported

earnings for the fourth quarter and the fiscal year ended April 30,

2009. For the quarter, basic earnings per share from continuing

operations were $0.31 compared to $0.28 a year ago. For the year,

basic earnings per share were $1.69, up from $1.68 in fiscal 2008.

The results include a $9.1 million pre-tax charge related to the

previously disclosed settlement of two wage and hour lawsuits.

Without the effect of the settlement, earnings would have been

approximately $1.80 for the year. �Despite this charge and a very

challenging economy, we were able to achieve record earnings and we

anticipate continuing our strong performance in fiscal 2010,ďż˝ said

President and CEO Robert J. Myers.

Gasoline�Casey�s annual goal in fiscal 2009 was to

increase same-store gasoline gallons sold 2% with an average margin

of 10.8 cents per gallon. For the year, same-store gallons were up

1% with an average margin of 12.9 cents per gallon. �The high

retail price environment held same-store gallons in check during

the first half of the fiscal year,� said Myers. �However,

same-store gallons improved during the second half of the year as

retail prices declined.ďż˝ Same-store gallons sold were up 1.2% for

the fourth quarter with an average margin of 12.1 cents.

Grocery and Other Merchandise�The Company�s goal was to

increase same-store sales 7% with an average margin of 33.2%. For

the fiscal year, same-store sales rose 5.9% with an average margin

of 33.5%; up 40 basis points from a year ago. Gains made in the

cigarette area and the continued popularity of high-margin

beverages were significant contributors to the growth. �We are

pleased with this category�s performance over the past several

years and remain encouraged about future growth opportunities,ďż˝

stated Myers. For the quarter, same-store sales increased 8% with

an average margin of 32.9%.

Prepared Food and Fountain�Casey�s annual goal was to

increase same-store sales 6.8% with a margin of 61.2%. Same-store

sales increased 9.1% during fiscal 2009, with an average margin of

61.4%. �The Company benefited from strategic price increases

implemented early in the year and was successful in negotiating a

forward buy that locked in our cheese cost through October 2009,ďż˝

said Myers. �In fiscal 2010 we intend to maintain the momentum by

expanding our coffee and fountain selections, introducing new menu

items and continuing the roll-out of our made-to-order sub sandwich

program.ďż˝ Total sales for the year were up 11.2% to $335.6 million.

Same-store sales in the fourth quarter rose 7.2%, with a margin of

62.7%; up 180 basis points from the fourth quarter a year ago.

Operating Expenses�For the fiscal year, operating

expenses increased 6.2%. In the fourth quarter, operating expenses

were up 7.1%. Without the effect of the lawsuit settlement,

operating expenses would have been up only 4.3% for the year and

down 0.6% in the quarter. �Lower fuel prices during the second half

of the year helped reduce our transportation costs and credit card

fees,ďż˝ stated Myers.

Expansion�The goal for fiscal 2009 was to increase the

total number of stores 4%. For the year, the Company increased the

store count by approximately 2%, with 16 new store constructions

and 16 acquired stores. �In addition to unit growth, we continue to

replace and remodel existing locations to meet the changing needs

of our customers,� stated Myers. �During fiscal 2009 we replaced 14

stores and completed 2 remodels utilizing the features of our new

store design.ďż˝

Fiscal 2010 Goals�Myers shared four corporate performance

goals for fiscal 2010:

- Increase same-store gasoline

gallons sold 2% with an average margin of 11 cents per gallon.

- Increase same-store grocery and

other merchandise sales 8.9% with an average margin of 33.9%.

- Increase same-store prepared

food and fountain sales 7.5% with an average margin of 62%.

- Increase the total number of

stores by 4%.

Dividends�At its June meeting, the Board of Directors

increased the quarterly dividend to $0.085 per share. The dividend

is payable August 17, 2009 to shareholders of record on August 3,

2009.

Casey�s General Stores,

Inc.Condensed Consolidated Statements of

Earnings(Dollars in thousands, except per share amounts)

ďż˝ ďż˝

ďż˝

Three months ended April 30,

ďż˝

Year ended April 30,

ďż˝

2009

ďż˝

ďż˝

2008

ďż˝

2009

ďż˝

ďż˝

2008

Total revenue

$ 883,015 $ 1,204,723

$

4,687,895 $ 4,828,793

Cost of goods sold (exclusive

of�depreciation and amortization,�shown separately below)

ďż˝

710,859

ďż˝

1,046,139

ďż˝

3,964,513

ďż˝

4,142,552

Gross profit

172,156 158,584

723,382 686,241

Operating expenses

125,325 116,975

504,181 474,794

Depreciation and amortization

17,369 16,973

69,406

67,651 Interest, net

2,892 2,780

10,626 9,792

Earnings from continuing

operations�before income taxes

26,570

21,856

139,169

134,004

Federal and state income taxes

10,997 7,401

53,425

49,031

Earnings from continuing

operations

15,573 14,455

85,744 84,973

Loss on discontinued

operations,�net of tax benefit of $12, $32,�$35 and $52

ďż˝

18

ďż˝

49

ďż˝

54

ďż˝

82

Net earnings

$ 15,555 $ 14,406

$ 85,690

$ 84,891 Basic Earnings from continuing operations

$

.31 $ .28

$ 1.69 $ 1.68

Loss on discontinued operations,

net of�tax benefit

---- ----

---- ---- Net earnings per common share

$ .31 $ .28

$ 1.69 $ 1.68 Diluted

Earnings from continuing operations

$ .31 $ .28

$ 1.68 $ 1.67

Loss on discontinued operations,

net of�tax benefit

---- ----

---- ---- Net earnings per common share

$ .31 $ .28

$ 1.68 $ 1.67

Casey�s General Stores,

Inc.

Condensed Consolidated Balance

Sheets

(Dollars in thousands)

ďż˝ ďż˝

April 30,

April 30,

2009 2008

Assets Current assets Cash and cash

equivalents

$ 145,695 $ 154,523 Receivables

10,888 16,662 Inventories

106,528 124,503 Prepaid

expenses

1,394 1,419 Deferred income taxes

11,895

8,398 Income taxes receivable

8,327 7,751 Total current

assets ďż˝ ďż˝

284,727 ďż˝ ďż˝ 313,256 Property and equipment, at

cost Land

273,406 249,842 Buildings and leasehold

improvements

568,366 523,748 Machinery and equipment

711,090 655,270 Leasehold interest in property and equipment

17,924 15,194

1,570,786 1,444,054 Less accumulated

depreciation and amortization

652,376 595,316 Net property

and equipment

918,410 848,738 Other assets, net of

amortization

8,582 8,898 Goodwill

50,976 48,308 Total

assets ďż˝

$ 1,262,695 ďż˝ $ 1,219,200 ďż˝

Liabilities

and Shareholders' Equity Current liabilities Current maturities

of long-term debt

$ 28,442 $ 34,383 Accounts payable

115,436 163,343 Accrued expenses Wages and related taxes

23,155 13,816 Property taxes

14,156 13,877 Insurance

19,111 18,265 Other

20,943 15,415 Total current

liabilities ďż˝ ďż˝

221,243 ďż˝ ďż˝ 259,099 Long-term debt, net of

current maturities

167,887 181,443 Deferred income taxes

125,536 105,959 Deferred compensation

11,085 10,201

Other long-term liabilities

15,914 15,026 Total liabilities

541,665 571,728 ďż˝ Total shareholders' equity

721,030

647,472 ďż˝ ďż˝ Total liabilities and shareholders' equity ďż˝

$

1,262,695 ďż˝ $ 1,219,200

Certain statements in this news release, including any

discussion of management expectations for future periods,

constitute �forward-looking statements� within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks,

uncertainties, and other factors that may cause actual results to

differ materially from future results expressed or implied by those

statements. Casey�s disclaims any intention or obligation to update

or revise forward-looking statements, whether as a result of new

information, future events, or otherwise.

ďż˝

Sales and Gross Profit by

Product(Amounts in thousands)

ďż˝ ďż˝ ďż˝ ďż˝ ďż˝

Year ended

4/30/09

Gasoline

Grocery & Other

Merchandise

Prepared Food

& Fountain

Other

Total

ďż˝

Sales $ 3,321,549 $ 1,010,018

$ 335,587 $ 20,741 $

4,687,895 Gross profit $ 159,787

$ 338,135 $ 205,954 $

19,506 $ 723,382 Margin 4.8%

33.5% 61.4% 94.0% 15.4% ďż˝

Gasoline

gallons 1,241,502 ďż˝ Year ended

4/30/08

ďż˝ Sales $ 3,559,245 $ 943,118 $ 301,702 $ 24,728 $ 4,828,793 Gross

profit $ 168,934 $ 311,959 $ 188,002 $ 17,346 $ 686,241 Margin 4.7%

33.1% 62.3% 70.1% 14.2% ďż˝ Gasoline gallons ďż˝ ďż˝ 1,214,932 ďż˝ ďż˝ ďż˝ ďż˝ ďż˝

ďż˝ ďż˝ ďż˝ ďż˝ ďż˝ ďż˝ ďż˝

Gasoline Gallons Gasoline Margin

Same-store Sales Growth (Cents per gallon, excluding credit

card fees) ďż˝ ďż˝ ďż˝ ďż˝ ďż˝ Fiscal ďż˝ ďż˝ ďż˝ ďż˝ ďż˝ Fiscal

Q1

Q2

Q3

Q4

Year

Q1

Q2

Q3

Q4

Year

F2009 0.5 % 0.2 % 2.1

% 1.2 % 1.0 % F2009

15.6ďż˝ 13.7ďż˝ 9.9ďż˝ 12.1ďż˝ 12.9ďż˝

F2008 0.3 -1.6 -3.9 -2.5 -2.0 F2008 15.8 13.6 13.5 12.6 13.9 F2007

ďż˝ -2.9 ďż˝ ďż˝ 2.7 ďż˝ ďż˝ 4.0 ďż˝ ďż˝ 2.8 ďż˝ ďż˝ 1.4 ďż˝ F2007 ďż˝ 9.8 ďż˝ ďż˝ 9.4 ďż˝ ďż˝

10.5 ďż˝ ďż˝ 11.8 ďż˝ ďż˝ 10.4 ďż˝ ďż˝ ďż˝

Grocery & Other Merchandise

Grocery & Other Merchandise Same-store Sales

Growth Margin Fiscal Fiscal

Q1

Q2

Q3

Q4

Year

Q1

Q2

Q3

Q4

Year

F2009 4.7 % 4.9 % 6.5

% 8.0 % 5.9 % F2009

34.0 % 33.9 % 32.9 %

32.9 % 33.5 % F2008 9.1 11.2 5.4 3.6

7.3 F2008 34.0 33.1 31.9 33.2 33.1 F2007 ďż˝ 2.3 ďż˝ ďż˝ 3.5 ďż˝ ďż˝ 6.7 ďż˝ ďż˝

7.3 ďż˝ ďż˝ 4.6 ďż˝ F2007 ďż˝ 32.2 ďż˝ ďż˝ 32.6 ďż˝ ďż˝ 30.8 ďż˝ ďż˝ 35.0 ďż˝ ďż˝ 32.7 ďż˝ ďż˝

ďż˝

Prepared Food & Fountain Prepared Food &

Fountain Same-store Sales Growth Margin Fiscal

Fiscal

Q1

Q2

Q3

Q4

Year

Q1

Q2

Q3

Q4

Year

F2009 12.3 % 9.3 % 8.1

% 7.2 % 9.1 % F2009

60.5 % 60.6 % 61.8 %

62.7 % 61.4 % F2008 9.5 10.6 8.4 11.2

9.8 F2008 61.7 63.0 63.6 60.9 62.3 F2007 ďż˝ 9.5 ďż˝ ďż˝ 13.7 ďż˝ ďż˝ 11.9 ďż˝

ďż˝ 8.5 ďż˝ ďż˝ 11.0 ďż˝ F2007 ďż˝ 62.9 ďż˝ ďż˝ 61.6 ďż˝ ďż˝ 62.1 ďż˝ ďż˝ 61.6 ďż˝ ďż˝ 62.0 ďż˝

Corporate information is available at

this Web site: http://www.caseys.com. Earnings will be reported

during a conference call on June 16, 2009. The call will be

broadcast live over the Internet at 9:30 a.m. CDT via the Investor

Relations section of our Web site and will be available in an

archived format.

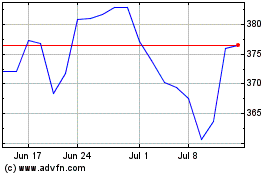

Caseys General Stores (NASDAQ:CASY)

Historical Stock Chart

From Apr 2024 to May 2024

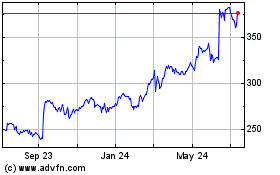

Caseys General Stores (NASDAQ:CASY)

Historical Stock Chart

From May 2023 to May 2024